Every manufacturer knows the rhythm of Q4. Budgets tighten, forecasts sharpen, and the familiar question emerges: “What do we do with the remaining year-end capital budget?” For some, it’s a scramble to spend before the fiscal clock resets. For others, it’s a strategic window to invest in packaging automation that will strengthen performance well into next year.

At IPM, we view your Q4 CapEx budget as an opportunity to align capital with measurable results. Through strategic packaging system integration and automation upgrades, manufacturers build momentum that improves uptime, throughput, and long-term ROI across manufacturing operations.

From Spending to Strategy

The strongest manufacturers don’t rush to spend remaining capital. They reinvest with purpose. They use Q4 to complete audits, lock scopes, and schedule design work so execution begins immediately after the new fiscal year opens.

This proactive approach not only protects budgets but accelerates ROI. It turns what might have been “use it or lose it” into “use it and gain from it.”

“Packaging machinery follows a three- to five-year investment cycle. 2025 marks the low point before the next upswing. Projects initiated now will capture cost and lead-time advantages before demand surges again.”

— PMMI 2025 State of the Industry Report

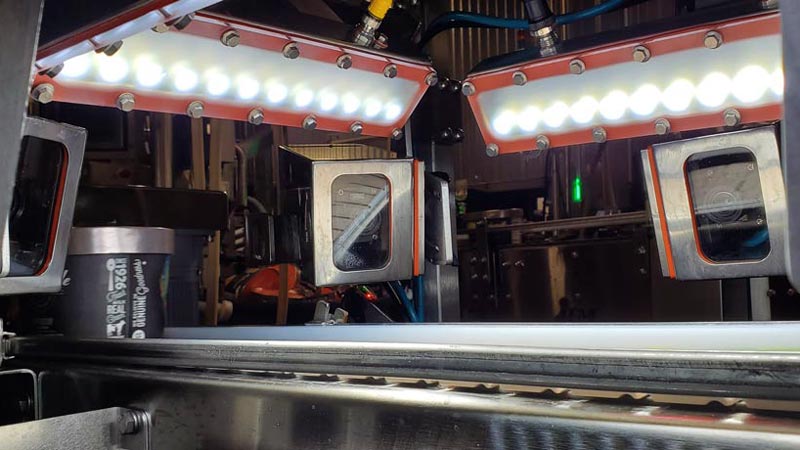

Integration: The Foundation of Every Capital Project

Smart capital spending ensures every part of the line performs together as one system. That’s why integration should anchor every year-end investment. It enables faster startups, more predictable uptime, and validated performance that delivers measurable packaging integration ROI in the first quarter of the new year.

Year-End Projects That Deliver Immediate ROI

The best time to invest is when preparation meets opportunity. Capital projects don’t need to be massive to create measurable gains before year-end. Some of the highest-return initiatives are those that improve runnability and readiness across existing operations.

- Packaging Line Audits: Identify bottlenecks and reclaim lost throughput before adding new capacity.

- Controls Upgrades: Enhance visibility, data collection, and system reliability with modern HMI and PLC platforms.

- Automation & Robotics Integration: Reduce labor dependency, improve consistency, and address safety or ergonomics challenges.

- Conveyance Optimization: Improve product flow and balance accumulation to achieve measurable uptime gains.

- Training Investments: Strengthen operator competency through EQUIPS™ programs that sustain performance well beyond installation.

Each of these initiatives builds on IPM’s full-lifecycle integration model, designed to deliver rapid time to value and a clear return on investment.

Execution That Accelerates ROI and Reduces Risk

IPM is proud to sponsor Dairy Processing’s Capital Spending Insights for 2026 webinar. The webinar offers an exclusive look at the investment priorities shaping next year’s manufacturing landscape.

Date: November 19, 2025 | Time: 2:00 PM EST

Join the live discussion to analyze current and future capital spending needs across the U.S. dairy industry, highlighting where companies are focusing their budgets on infrastructure, automation, technology, sustainability, and supply chain logistics.

Attendees will:

- Understand the major areas of dairy capital investment for 2026.

- Learn how evolving market and regulatory dynamics influence spending decisions.

- Gain actionable data to inform long-term strategy and policy planning.

Plan Now. Perform Stronger Next Year.

Year-end capital decisions define next year’s performance. Whether you’re pursuing new manufacturing capital projects or accelerating planned upgrades, now is the time to align those resources with measurable outcomes.

Before the fiscal clock resets, talk with IPM about investments that convert this year’s capital budget into next year’s measurable uptime and performance.